My Million Dollar Crypto Lesson: How to Lock in Gains Before the Crash

In the chaotic, high-stakes world of crypto, one lesson stands taller than the rest: making money is easy—keeping it is the real game.

In the last bull cycle, I watched over $1 million vanish from my crypto portfolio in just one week. That gut-wrenching loss was the wake-up call I didn’t know I needed. This time around, I’m playing smarter—and if you’re reading this, so can you.

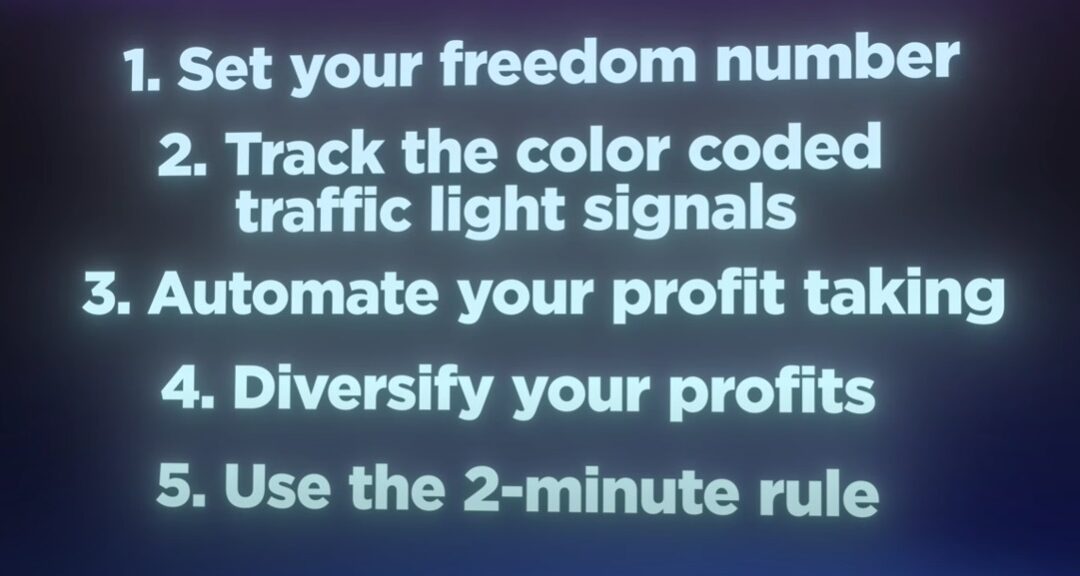

Here’s my 5-step blueprint to lock in your gains before the next crash sends markets into a tailspin.

My 5-Step Crypto Exit Plan [Cash Out Before the Crash]

Step 1: Define Your Freedom Number

What’s your goal? Not some fantasy 50x moonshot—your realistic, freedom-enabling number.

-

For some, it’s a 2x to pay off debt.

-

For others, it’s a 5x to fund a year of financial freedom.

Choose your target based on your risk tolerance and life goals. The higher your number, the more risk you’ll need to take. But knowing this number gives you a psychological anchor to take profits when emotions run wild.

Step 2: Track the Market’s Traffic Light

Trying to time the top? Use data, not hope.

I use a color-coded dashboard to know when things are overheating:

🚦The 3 Key Traffic Lights:

-

Pi Cycle Top Indicator – Historically accurate within days of Bitcoin peaks.

-

MVRV Z-Score > 7 – Tells you BTC is likely overvalued.

-

Funding Rates – Sky-high rates mean retail is overleveraged = danger zone.

If all 3 are red, I go nearly full risk-off. If 1–2 are flashing, I get cautious.

Important caveat: Institutional adoption (thanks to ETFs) is reshaping this cycle. But these indicators still provide crucial context.

Step 3: Automate Your Profit Ladder

If you wait for the “perfect top” to sell, you’ll miss it. That’s why I automate my take-profit system.

📈 Here’s how I do it:

-

For Bitcoin, I might sell 20% every time it goes up 20%.

-

For higher-risk altcoins (like Solana), maybe sell 25% every 50% pump.

-

For meme coins, I always take out my original investment after a 2x—this makes it “house money” and lowers emotional pressure.

This system ensures I’m banking profits before the rug gets pulled. Plus, it gives me dry powder to buy dips.

Step 4: Place Profits Into Buckets

What do you do with profits once you sell?

Avoid the trap of leaving everything in stables on exchange. That’s like leaving chips at the poker table. Here’s my cash management framework:

🪙 My 3 Profit Buckets:

-

40% – US Treasury yields (outside crypto)

Keeps me from overtrading. Adds friction. -

30% – Yield-bearing stables in DeFi

Earn passive income. Only in audited, diversified protocols. -

30% – Flat stables (some in cold storage)

Instant liquidity for “stink bids” on crashes.

This strategy gives you flexibility, security, and income—a triple threat in volatile markets.

Step 5: Master the Mental Game (2-Minute Reset)

You don’t lose to the market—you lose to your own psychology.

Every Sunday, I run a 2-minute mental reset:

-

Deep breaths – Calm before action.

-

Review take-profit plan – Stay aligned.

-

Update limit orders – Be prepared.

-

Log emotions – I use ChatGPT to journal weekly wins, mistakes, and next steps.

This weekly ritual saved me $500K during the last correction. One Sunday reset, one updated order, and boom—profits locked before the crash.

🚀 Recap: The 5-Step Profit-Locking Blueprint

-

Set your Freedom Number

-

Track traffic light indicators

-

Automate your take-profits

-

Bucket your gains wisely

-

Use the 2-minute mental reset

Take a screenshot. Stick it on your wall. Execute.

Because crypto isn’t just about catching the next 10x…

It’s about walking away with your bag still full.